Blog post

Copay assistance programs assist insurers, not individuals, with accumulator copay policy

Editor's note: This blog post contains a number of insurance-related terms that may not be familiar to everyone. To help you understand the protections this new bill provides, we have included a glossary at the end of the post to explain what those terms mean.

If you have a chronic illness like kidney disease, you probably depend on medications to help treat your disease and its symptoms. Unfortunately, these drugs are often very expensive, even if you have health insurance. In an effort to make medications more affordable for people with chronic illnesses who are struggling financially or from low-income households, drug manufacturers have created copay assistance programs. The American Kidney Fund (AKF) supports copay assistance programs, as they help consumers afford their prescription drugs, which in turn can improve health outcomes. The programs help people with kidney disease avoid being in the awful position of choosing between life-saving treatment and other basic needs like rent or groceries.

When these programs were originally introduced, you could count the amount of your copay assistance program coverage toward your deductible or other cost-sharing responsibilities. When you have reached your deductible, your health insurance company would pick up a larger part or all of your health care costs depending on your plan and its cost-sharing requirements between hitting your deductible and your annual out-of-pocket maximum.

Insurers refer to this as their "accumulator copay policy." During the past few years, many health insurance companies have changed their policy to not allow patients to use these programs to count toward their deductible. This policy change has brought large profits to insurers, while creating new financial hardships for consumers. It allows the insurer to pay less for the drug without passing the reduced price of the drug to the patient.

Every year, the U.S. Department of Health and Human Services (HHS) issues rules to govern Affordable Care Act (ACA) health insurance plans called the Notice of Benefit and Payment Parameters (NBPP). The 2021 NBPP permitted health insurance companies to use the accumulator copay policy for the manufacturers' copay assistance programs. Although there were hopes that HHS would change its ruling, on April 28, 2022, HHS posted the final 2023 NBPP, allowing the accumulator copay policy to continue.

On November 2, 2021, Reps. Donald McEachin (D-VA) and Rodney Davis (R-IL) introduced H.R. 5801, the Help Ensure Lower Patient (HELP) Copays Act. The bill would require that health insurers apply the money in the manufacturers' copay assistance programs to count toward an individual's cost-sharing, helping people pay for their necessary medications as the program was originally designed to do.

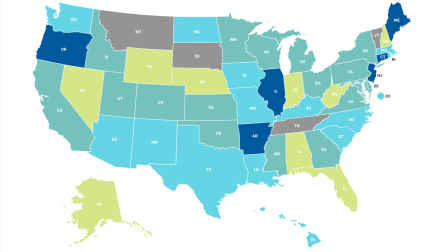

Currently, 14 states and Puerto Rico have laws that require health insurers to use manufacturers' copay assistance programs to count toward a person's deductible.

Want to help? Contact your representative today and ask them to cosponsor this important legislation.

Glossary

Annual out-of-pocket maximum: The total amount of money that you must pay for health care services before insurance will provide full coverage. This does not include your premium (see below). Once you hit your annual out-of-pocket maximum, all services should be provided without any cost-sharing.

Coinsurance: The amount that you pay when you have a health care service provided. The amount is based on a percentage of the cost, and the percentage is outlined in your health insurance policy.

Copay: A predetermined amount that you pay when you have a health care service provided. It is a flat rate (not a percentage), and the amount is outlined in your health insurance policy.

Cost-sharing: The amount you are responsible to pay in addition to your premium. Cost-sharing can be coinsurance or copays. It can also include your deductible and costs that lead to your out-of-pocket maximum.

Deductible: The amount you must pay in addition to your premium before insurance coverage or different coinsurance or copays start. Please be aware that because of the Affordable Care Act, most preventative services, such as your yearly wellness physical, well woman examinations, mammograms or cancer screenings, must be provided for free.

Premium: The amount you pay usually monthly or quarterly for your health insurance plan.